Introduction

The Dynamic Client Registration (DCR) API provides a mechanism to dynamically register OAuth 2.0 clients with authorization servers. With the use of the DCR API, the OAuth 2.0 client applications can register with banks in a seamless and fully-automated process. The API consumer applications go through an in-depth verification during DCR to make sure the application is authorized and secured before sharing customers’ financial data.

The API consumer applications may send registration requests with a set of desired client metadata values. The bank then provides real-time responses with a client identifier and client metadata values registered for the application. The application can then use the client ID in the registration information to communicate with the bank.

The bank needs to provide the DCR API from its open banking solution and WSO2 Open Banking Accelerator provides the DCR capabilities with an endpoint that performs the following: - Validates if the API consumer application is authorized by a competent authority - Validates information such as the role of the API consumer, signature algorithm, authorization scopes, OAuth2.0 grant types, application type, and the request issuance time - Allows registered API consumer applications to access data via open banking APIs

Note

The Dynamic Client Registration functionality available in WSO2 Open Banking Accelerator meets the open banking requirements including OAuth2.0 and OpenID Connect standards.

How Dynamic Client Registration works¶

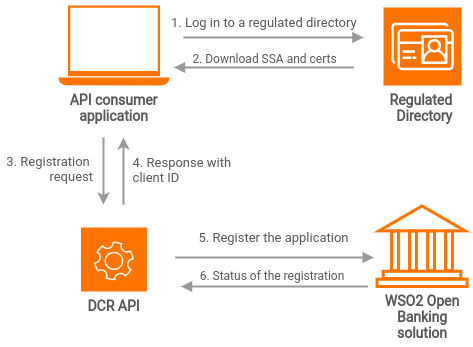

API consumer applications use the DCR API to register with a bank and obtain access to open banking APIs to retrieve details needed for the application functionalities. It is a standard API that registers an application and responds with a client ID and registration details. The API consumer applications can use these credentials to obtain application access tokens that are required to invoke the open banking APIs.

- Before registering in the bank, the API consumer applications have to register with a regulated directory. After successful registration, they can obtain signing and transport certificates from the directory.

- A Software Statement Assertion (SSA) is also generated for a particular application and they can download this assertion.

- Now, the API consumer applications can invoke the DCR endpoint of the desired bank and register. This registration happens through an API call and no prior token is expected. However, communication should take place through a channel protected by mutual TLS.

- The registration request is an encoded JSON Web Token (JWT), which is signed by the signing certificate obtained from the regulated directory. The request payload also contains the encoded and signed SSA.

- After successful validation of the request, the API consumer applications receive a client ID, which they can use to obtain application access tokens and access banking APIs.

You can customize the validations performed in the DCR process according to your specification and other requirements. For information, see writing a custom DCR validators.

Top