Open Banking

What is Open Banking?¶

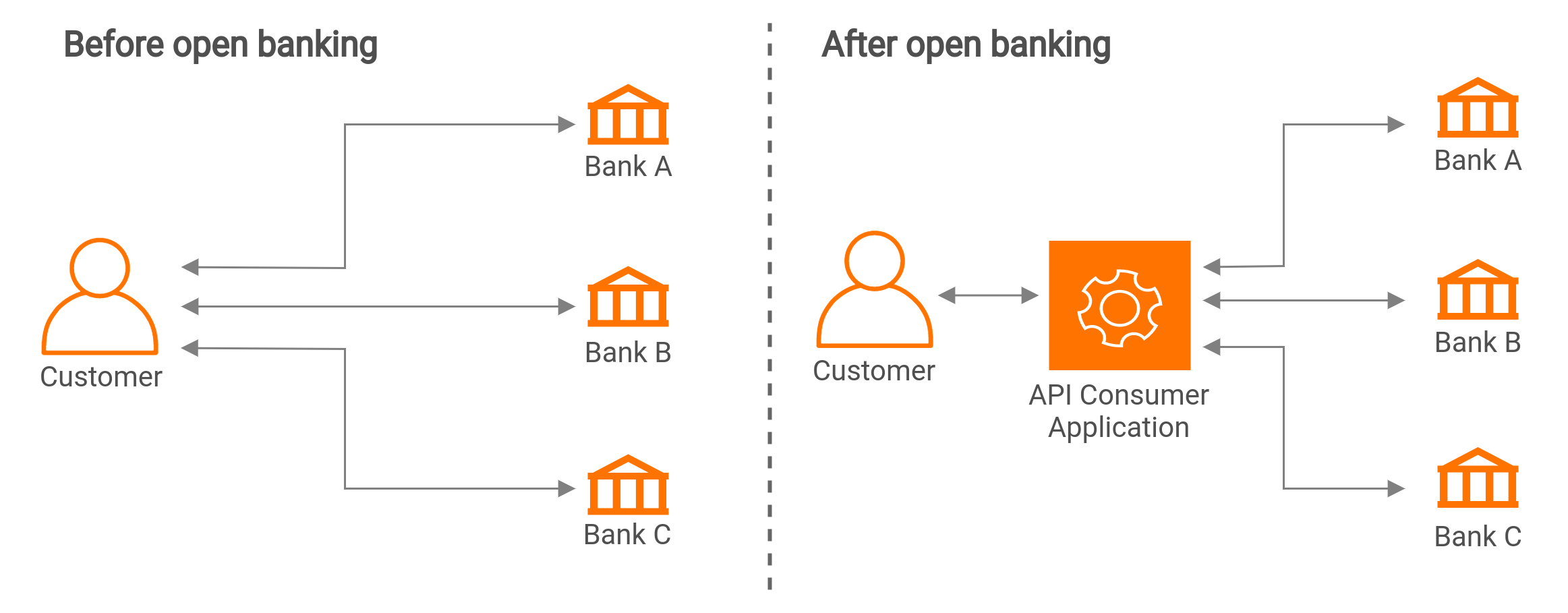

Open banking is a concept that enables banks, customers, and third parties to use and benefit more from the vast silos of data held by banks on their customers. Fundamentally, open banking allows bank customers to share their financial data with third parties with their consent. In technical terms, this is done via secure APIs that allow the customers or authorised API consumer applications to access data held by the bank. It is envisioned that upon wide adoption, an ecosystem of APIs would be created with various third-party applications, services and intermediary platforms integrating with banks to reinvent financial services using customer data.

This gives customers more control over their data and greater financial transparency. It enables non-banking financial service providers and newer entrants such as fintech to participate more actively and meaningfully in generating customized user experiences for consumers. Open Banking reshapes the banking industry by encouraging networking of data and innovation across various financial institutions.

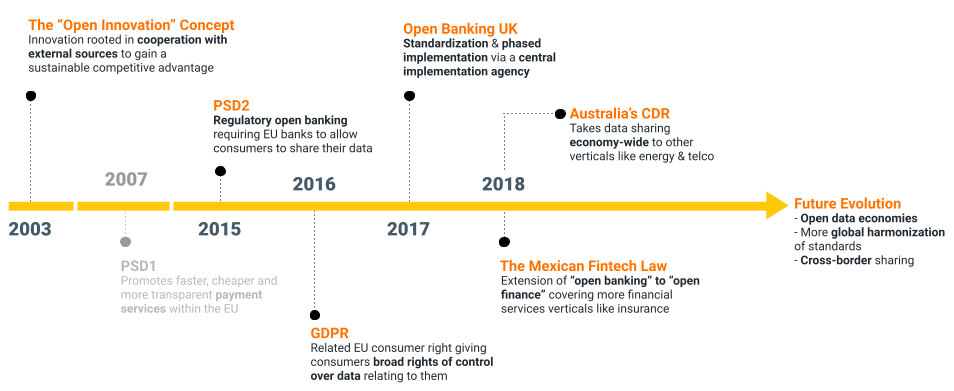

The Open Innovation Concept defined by Henry Chesbrough at Berkley promotes innovation rooted in cooperation with external sources to gain a sustainable competitive advantage. This concept contradicts secrecy and siloed methods. Open banking stems from this concept. Then introduced a legal framework known as PSD1 to promote faster, cheaper and more transparent payment services within the European Union (EU) impacting how incumbents operate and promoting the entry of new players. PSD2, which is the revised version of PSD1 introduced the concept of open banking by regulatory means requiring banks across the EU to allow consumers to share their data with authorized third parties. GDPR introduced a composition to data privacy laws across the EU. GDPR and PSD2 interrelate in terms of consent for data sharing and preserving rights of control for consumers over their data. The world has embraced and extended the open banking concept according to their requirements. Countries and regions have established their own standards and implemented them in phased approaches. Certain countries are experimenting with an extension of open banking, known as open finance that enforces data sharing across financial service verticals. In addition to this, there are economy-wide data sharing propositions like the Australian CDR. Economy-wide efforts are now playing out in the UK - Smart Data and the EU as well. For more information on current regulations and standards, see open banking regulations and standards.

A sample open banking use case¶

Open Banking has several use cases and advantages. Here’s one example of how open banking works in practice. If you are a customer who is looking for housing loans, open banking can enable a loan comparison service to access your financial data so that the service can suggest you the most suitable options based on your financial history.

Open banking enables customers to view all bank accounts in one place making it easier to manage and budget. They also have the benefit of making all their payments using a single third-party provider application on behalf of them.

Stakeholders in Open Banking¶

The open banking ecosystem comprises 4 main stakeholders.

-

Customer - The owner of a bank account who can grant access to the API consumer applications to retrieve account information or initiate payments on their behalf. With open banking in the picture, the owner can use a single application to manage the accounts and initiate a payment on behalf of them. The customers have more control over their data as they can manage and revoke the API consumer applications’ access to the financial information.

-

API consumer application - An authorized third-party financial service provider that uses standard APIs to access customer’s accounts. API consumer applications play several roles such as retrieving account information, initiating payments on behalf of the customers, and checking available funds.

-

Financial institution - An entity such as a bank that provides and maintains a payment account for a customer. With customer consent, they share account and transaction data via API endpoints and let API consumer applications make payments on behalf of the customer.

-

Merchant - A vendor who accepts online payments in exchange for their products or services. A merchant can use a single API consumer application to accept payments easily from multiple banks. Unless the customer wants to make a payment from their bank account, the role of a merchant is not available in all open banking use cases.

There are other stakeholders such as the government, technology providers, and consultancy service providers that are involved in open banking.

Customer Stories and Use Cases¶

WSO2 Open Banking Accelerator delivers comprehensive technology and strategic consultancy to help you execute standards-compliant, commercially successful open banking initiatives. For more information, see our customer stories and use cases.

Top