Integration

WSO2 Open Banking can be easily integrated into your current banking system.

By default, WSO2 Open Banking Accelerator contains a mock back end that acts as the bank back-end server. In a production environment, you need to set up and configure the solution with your banking system. This documentation explains the integration points and APIs that your banking system needs to provide.

Bank back end integration¶

The integration capabilities of the API Manager 4.1 can help you make the bank back end compatible with WSO2 Open Banking. For more information, see Developing Your First Integration Solution.

Consent REST API¶

When interacting with the consent module, you can use the Consent REST API exposed by WSO2 Open Banking Accelerator.

Sequence files¶

In a production environment, you can deploy your own APIs and configure sequence files. Steps to try out the sample flow is available here. By default, the solution contains a mock back end and a sample sequence file as follows:

<sequence

xmlns="http://ws.apache.org/ns/synapse" name="accounts-dynamic-endpoint-insequence">

<property name="endpointURI" expression="get-property('To')"/>

<!--Appending Basic Auth for Consent Management APIs -->

<property name="Authorization" scope="transport" action="remove"/>

<header name="Authorization" value="Basic YWRtaW5Ad3NvMi5jb206d3NvMjEyMw==" scope="transport"/>

<filter regex=".*\/account-access-consents.*" source="$ctx:endpointURI">

<then>

<header name="To" value="https://<IS_HOST>:9446/api/openbanking/consent/manage" />

<header name="x-wso2-client-id" expression="get-property('api.ut.consumerKey')" scope="transport"/>

</then>

<else>

<header name="To" value="https://<APIM_HOST>:9443/api/openbanking/backend/services/accounts/accountservice" />

</else>

</filter>

</sequence>- Update the placeholders with the hostname of your Identity Server and API Manager servers.

- Replace the

/api/openbanking/backend/services/accounts/accountserviceURL with the API from your bank back end.

Follow the above sample and configure your sequence files to connect the bank back end to the WSO2 Open Banking solution.

Account-Request-Information header¶

The WSO2 Open Banking solution manages the initiation and authorisation of a consent. When an API consumer application

makes a request to retrieve any account information, the solution validates the consent against the request. Upon

successful validation, consent-related information is directed to the core banking system in the form of a header. This

header is known as Account-Request-Information.

The Account-Request-Information header is a signed JWT, which needs to be decoded by the core banking system.

Click here to see the decoded format of a sample header

The decoded JWT header is in JSON format and looks as follows:

{

"clientId":"EkpvjD6O8P8Px8RrBYJx1mMw78Ua",

"currentStatus":"authorized",

"createdTimestamp":1621616438,

"recurringIndicator":false,

"authorizationResources":[

{

"updatedTime":1621616455,

"consentId":"b10a4458-0354-4fde-b259-5bbd3066d445",

"authorizationId":"5d290705-dd5c-43f2-98a0-3afc58e1c4bc",

"authorizationType":"authorization",

"userId":"[email protected]@carbon.super",

"authorizationStatus":"authorized"

}

],

"updatedTimestamp":1621616455,

"validityPeriod":0,

"consentAttributes":{

},

"consentId":"b10a4458-0354-4fde-b259-5bbd3066d445",

"consentMappingResources":[

{

"mappingId":"e5fe1b24-05f1-4f52-be10-55cb4b58b2a9",

"mappingStatus":"active",

"accountId":"30080012343456",

"authorizationId":"5d290705-dd5c-43f2-98a0-3afc58e1c4bc",

"permission":"30080012343456"

}

],

"consentType":"accounts",

"receipt":{

"Risk":{

},

"Data":{

"TransactionToDateTime":"2021-05-24T22:30:32.995+05:30",

"ExpirationDateTime":"2021-05-26T22:30:32.936+05:30",

"Permissions":[

"ReadAccountsBasic",

"ReadAccountsDetail",

"ReadBalances",

"ReadBeneficiariesBasic",

"ReadBeneficiariesDetail",

"ReadDirectDebits",

"ReadProducts",

"ReadStandingOrdersBasic",

"ReadStandingOrdersDetail",

"ReadTransactionsBasic",

"ReadTransactionsCredits",

"ReadTransactionsDebits",

"ReadTransactionsDetail",

"ReadStatementsBasic",

"ReadStatementsDetail",

"ReadOffers",

"ReadParty",

"ReadPartyPSU",

"ReadScheduledPaymentsBasic",

"ReadScheduledPaymentsDetail",

"ReadPAN"

],

"TransactionFromDateTime":"2021-05-21T22:30:32.995+05:30"

}

},

"consentFrequency":0

}Given below is a brief description of the fields in the header:

| Field | Description |

|---|---|

| clientId | The unique ID of the API consumer application. |

| currentStatus | The current status of the consent. |

| createdTimestamp | The date and time when the consent was created. |

| recurringIndicator | Specifies if this is a recurring transaction. |

| authorizationResources | Contains details regarding the consent authorization. |

| updatedTimestamp | The last date and time the consent was updated. |

| validityPeriod | The validity period of the consent in seconds. |

| consentAttributes | Extra attributes related to the consent. |

| consentId | The unique ID of the consent that is being authorized. |

| consentMappingResources | The details of the accounts that the consent is bound to. |

| consentType | The type of the consent. For example, accounts, payments. |

| receipt | Details of the consent, such as expiration time, permissions. |

| consentFrequency | The maximum frequency for access without customer involvement per day. |

The core banking system will perform all required validations and build a response. This response needs to adhere to the requirements in your open banking standard.

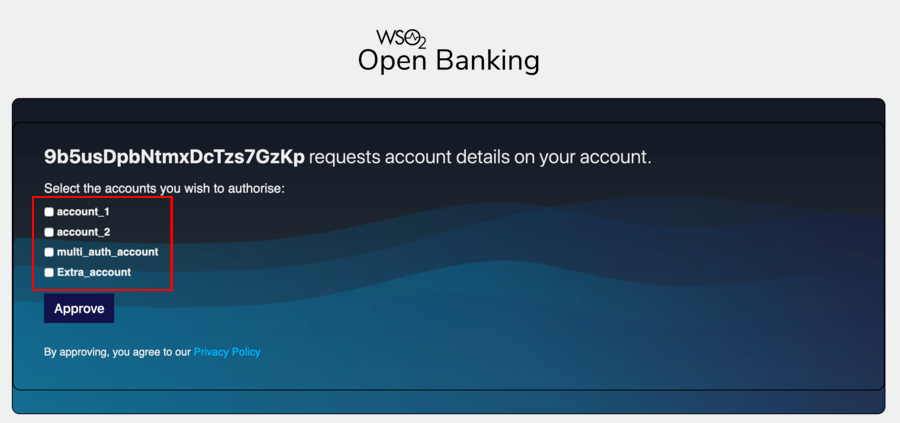

Shareable and payable accounts¶

Some bank customers may have a certain number of bank accounts in a particular bank, but not all these accounts have the ability to be shared externally or to make a payment online. These accounts are known as shareable and payable accounts respectively. In a bank, the list of shareable accounts and the payable accounts can either be the same or different.

The WSO2 Open Banking solution expects at least two APIs from the bank that return shareable and payable accounts when

the user_id is provided. The response must be in the JSON format and it will automatically load the accounts list on

the consent page during the consent authorization flow.

The responses of shareable and payable accounts APIs depend on your open banking specification and what you need to display on the consent page. You can configure customized steps for retrieval by following the Consent Authorize endpoint documentation.

Top